Credit & Debt Q & A

Without credit, it is unlikely that you will be financially successful in today’s economy. While you can service some of your needs with cash or a checking account, without credit, you cannot borrow money, use a credit card, rent a car or shop online.

Without a credit history, you may face difficulties in finding employment, renting an apartment, buying a home, getting insurance, applying for a college loan or bankrolling a

new business.

However, establishing credit can be a catch-22. This is especially true for young people. With no credit history, their application for credit — perhaps for their first credit card — is often denied. And without a credit card, they are unable to build the credit history necessary to obtain it.

There still remain ways to establish credit, use credit and strengthen a credit report.

Find a Co-Signer

If you can’t get your credit history started by taking advantage of one of those “pre-approved” credit cards, finding a co-signer for a personal loan or credit card might the fastest and easiest way to get started.

It also is fraught with enough danger to scare people away from doing it.

Most people select a parent, but a close relative or friend also could serve as a co-signer. Having a co-signer with a strong credit score can help lower the interest rate for a credit card, auto loan or personal loan because most lenders consider the highest score available when making a loan.

The co-signer is telling the lender that if for any reason you default, the co-signer will take 100% of the responsibility for paying off the credit card or loan, including interest and penalty fees. In other words, there is as much pressure on the co-signer to repay the loan or make credit card payments as there is on you.

There is no problem if you make on-time payments for your credit card. In fact, if you are on time with credit card payments for a year, you demonstrate enough responsibility to get credit on your own and can have the co-signer removed.

Co-signers for a credit card are viewed as “co-owners” of the card. Anything negative or reckless done by the cardholder reflects negatively on the co-signer. So, maxing out a credit card — even if you pay it off at the end of the month — and making late payments can have a negative effect on the co-signer’s credit score.

Opening a Bank Account

Banks are a prime resource for credit cards and personal loans. If you want credit, a great place to start is opening a savings or checking account (or both).

Most people establish a bank account during their teenage years as a place to save money and pay bills. A checking account introduces the basics of using income to pay bills. You also learn about penalties when expenses exceed the amount available in your account, leaving you with overdraft fees.

Most banks will look at your checking account activity when you apply to them for credit. If you have demonstrated responsible handling of money — including paying your rent and utilities on time and maintaining a stable residence — it may be enough for them to offer a credit card account without requiring a co-signer.

The longer you can show both a steady income coming into your account and reliable bill payments going out, the better your chances for receiving credit cards or loans from your bank.

Secured Credit

A bank or credit union may be willing to offer you a secured line of credit that uses the funds you already have in your account as collateral. This covers your credit card bill if you don’t pay it. If you have $500 in your account, the bank can issue a credit card with a $500 spending limit.

When the credit card bill comes in, the bank deducts the amount due from your account and as long as there is still $500 remaining, your “secured” credit card is still good. Once you’ve established a good record of payment, you should be able to graduate to a standard, unsecured credit card.

Limited Credit

Some banks offer limited credit to young adults and college students in the form of high-interest credit cards with low credit limits. (Your interest rate is the premium you pay for the privilege of borrowing money; your credit limit is the maximum amount that you can spend.)

With one of these cards, you can establish a positive credit history by using it sparingly and by making regular monthly payments. In time, you qualify for a card with a lower interest rate and a higher spending limit.

When the credit card bill comes in, the bank deducts the amount due from your account and as long as there is still $500 remaining, your “secured” credit card is still good. Once you’ve established a good record of payment, you should be able to graduate to a standard, unsecured credit card.

Retail or Gas Cards

If you can’t get a standard bank-issued credit card, you may find it easier to get a department store credit card or an oil company card for buying gasoline, since those usually come with more lenient approval requirements.

Same-As-Cash Offers

You may be able to finance a purchase in a store that advertises a same-as-cash-offer. This is a deal that allows you to pay no interest for a set time period. If you pay off the principal balance, which is the item’s purchase price, within that time period, and the store reports your transactions to the credit bureaus, your credit report will be positively impacted.

Auto Loan

If you have the cash to buy a car, you can establish credit by buying a car that’s financed by a dealership. A car loan is secured by the vehicle, so if you don’t pay it off, the dealer can repossess the car. This strategy entails taking out an auto loan and then paying it off in full after you’ve made just one (or a few) monthly payments. You will end up paying a minimal amount of interest and your credit report will reflect a responsible use of credit and on-time payments.

Long-Term Employment

An often-overlooked way to establish and build credit is long-term employment, which offers several benefits that can make you a more attractive candidate in the eyes of a lender. Long-term employees generally receive more company benefits, including access to promotion, less chance of being laid off and demonstrating stability in your professional life.

Most importantly, salaries typically increase as you move up the ladder and the combination of stability and increased financial clout makes you a good candidate for credit.

Once You Have a Card

When you start using a credit card, you are usually given a low credit limit. Lenders watch closely to determine how much more credit they will allow and what terms and conditions they will make part of any future loan agreements.

There are five factors that make up your credit score. In order of importance, these include:

a) Payment history

B) Credit utilized

C) Length of credit history

D) Types of credit used

E) New credit

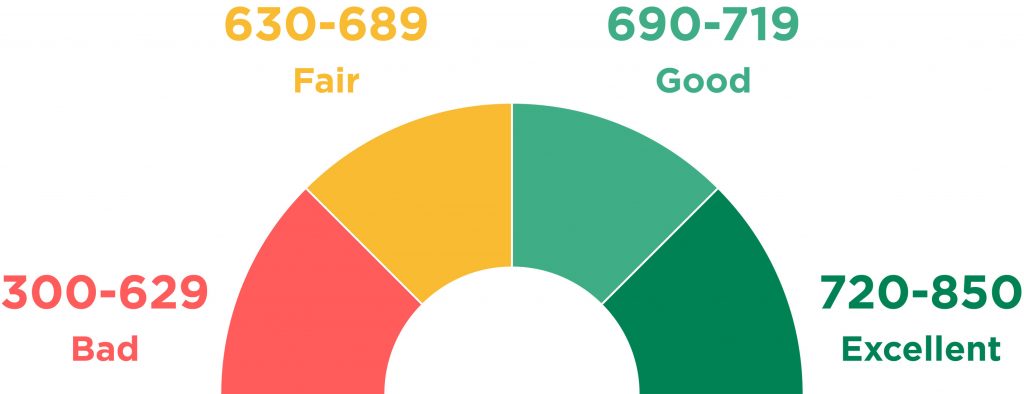

The data that supports these five areas is compiled by the three major credit bureaus, Experian, Equifax and TransUnion, to come up with a credit score. Your credit score is a 3-digit number that projects how likely you are to pay your debts. The higher your score, the more likely you are to pay debts.

You are entitled to one free credit report a year from each bureau. It is wise to request those reports and examine them closely because errors are made that directly affect your credit score.

Credit Can Affect Employment and Housing

There are side benefits to establishing and building a good credit record. These include improving your job prospects and your chances of renting a home or apartment.

The Society for Human Resource Management says that 47% of employers in a 2012 survey used credit checks when making a hiring decision. A good credit score is viewed by some employers as evidence of your integrity and responsibility. Conversely, a poor credit score is viewed as a sign of irresponsibility and could eliminate you from consideration for a job. Employers must tell you if they do use your credit history against you in the hiring process.

The same subjective judgment comes into play when you apply for housing. Landlords will look at credit scores as a way to gauge your reliability at making monthly rent payments. Depending on the amount being charged for rent, a score above 650 puts you in the “low-risk” category, meaning you should be able to handle monthly payments.

Build Up to Better Terms

Remember that the object is to build a positive credit history that will allow you to apply for more credit down the road — at better terms.

Once you have established credit, charge purchases instead of paying by cash or check and make your credit card payments on time. Regularly check your credit score and understand your rights under the law in disputing any incorrect or inaccurate information on your credit report.

Don’t apply for more credit than you can actually use and afford. Spend responsibly and in no time at all, the very same card companies or banks that denied your initial credit request, will be inundating your mailbox with more offers than you’ll ever need.